Introduction

Madagascar

Context

As feared last year, the cancellation of the minimum FOB price in April 2023, due to international diplomatic pressure, has led to a significant drop in export prices across the board.

From a minimum export price set at USD 250 per KG, we saw prices drop below USD 20 per KG for the lowest vanilla grades. Price pressure came mostly from North America, an expected situation from businesses trying to average out the cost of their expensive stock.

In addition, due to the market situation and the presidential elections on the island in November 2023, little attention was given to the vanilla market and other major natural product commodities, such as lychee, cloves and black pepper. As a result, exports only re-opened in December 2023, a highly unusual situation compared to previous years.

Volumes

Last year, we reported an estimated production of around 2,000MT with an additional 1,000-1,500MT carryover from the 2022 season, which meant the 2023-2024 season started with a volume as high as 3,000-3,500MT.

So far in 2024, over 2,400MT of vanilla have been exported in the first half of the year. When exports close at the end of July as usual, which could potentially change, with outbound shipments continuing at this rate, we could see export volumes reaching nearly 3,000MT. A lower local carry-over would still remain before the 2024-2025 season.

With lower blossoming witnessed at the end of 2023, we expect a production of around 1,400MT for the 2024-2025 season, a drop of about 30% compared to last year. A limited local carry-over could bring the total availability to 1,500 to 1,800MT. It is difficult to say if the market is still considered to be oversupplied, especially when we observe that buyers are well stocked, benefitting from low prices.

Quality of the vanilla

From experience we observe that oversupply and/or low price years generally bring higher quality vanilla, as it becomes a differentiating factor for farmers hoping to maximize their revenue. High quality beans are left on the vines as long as possible, leading to ideal maturity and thereby, higher vanillin content.

Despite our fears of blending last year (cf: Vanilla Global Market Report – June 2023), the 2023 crop yielded outstanding quality vanilla beans at relatively low prices. However, it should be noted that availability of higher grades, like Black grades vanilla beans, was limited compared to the market demand.

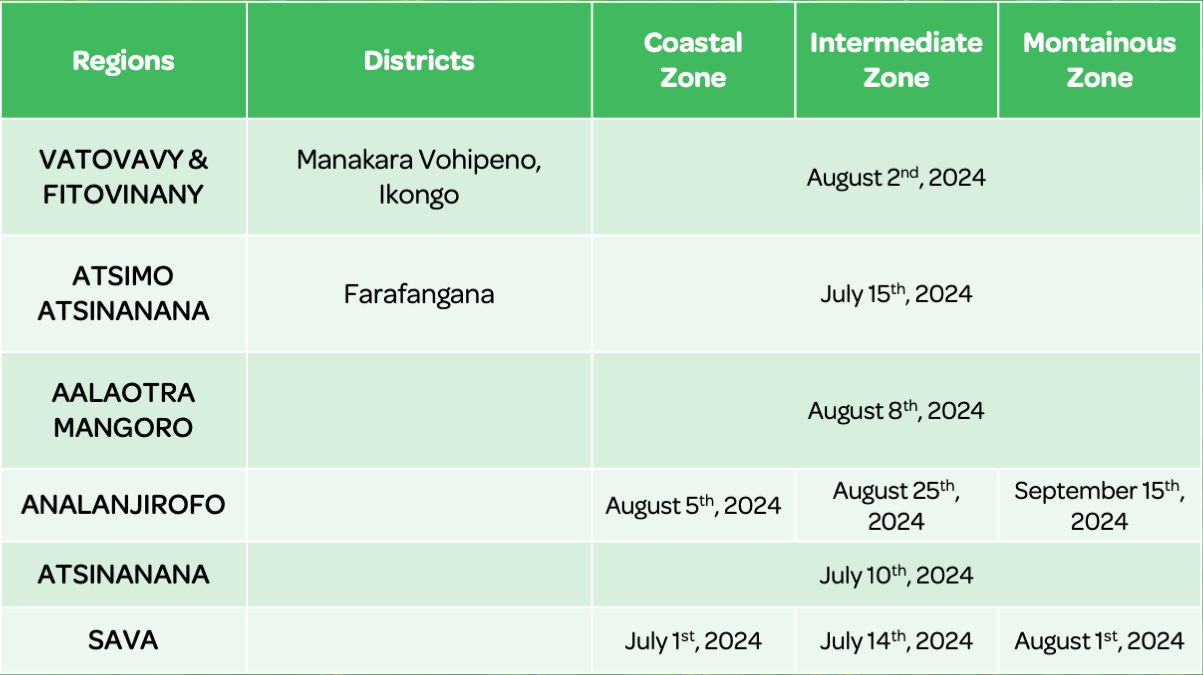

For 2024, we have some concerns about quality due to two main factors. First, after a year of very low prices, the financial situation of farmers is extremely difficult, which may push them to pick beans too early out of desperation. Plus, the opening date of the Green Campaign appears to be 2 weeks too early for Sava region, and 2 weeks too late in the Analanjirofo region.

This sentiment seems to be shared by local actors on the ground, as we witnessed little to no activity on the market in the first week of the opening in the Sava region.

Cyclone Gamane & speculations

In March 2024, Cyclone Gamane made landfall in the Northeast area of Madagascar, which is the vanilla-producing region of the island. Our teams on the ground did not witness a significant enough impact on vanilla crops to affect the market; however, a narrative of widespread vine damage even reached reputable international media.

With obvious intentions, the narrative created a sense of impending scarcity, leading to an immediate price increase as a result, sometimes as much as 20% higher.

The belief that Cyclone Gamane damaged the crops, along with reduced flowering and attractive low prices, have promoted purchases and boosted exports. Given the persistent logistical challenges on the island, the buying pressure remained evident in the months following the weather event.

There were some concerns regarding the state of the infrastructure that was damaged by the cyclone. Repairs have been underway, and while roads and bridges are not 100% operational yet, our team observed that they are currently in a good enough state for the movement of prepared vanilla from the Northeastern region to the hotter and drier Northwestern region near Ambanja.

For these reasons, volumes this year have been sustained since the opening of exports in late Q4 2023. At the time of this writing, the logistics business in Madagascar has been functioning at maximum capacity for the past 6 months, with buyers taking long positions in anticipation of a price increase and scrambling to secure quantities before the closing of exports. As such, we observe widespread delays in shipping.

Government policies

Today, there is still much uncertainty surrounding the government policies and administration of the upcoming season.

While not official, a set minimum export price of USD 60 per KG has been mandated by the government and enforced by customs since beginning of July, which local actors are required to respect.

As mentioned above, the Green Campaign official dates were published, finally, on the same day as the opening date, giving little notice to farmers and buyers.

Exports are scheduled to close on 31st July 2024, but there is still some uncertainty on whether exporters will be allowed to export their declared quantities of the previous season after the end of July.

There is still no fixed date for the re-opening of exports, but rumor of a December re-opening is going around. Today we are still waiting for the official list of exporter licenses for the 2024-2025 season, but no update has been published to date.

Download our product informations

We can share with you our product catalog and our sales will be happy to assist you further.

Please fill in the form to receive our product list.

- Certified

- Sustainable & Ethical

De Monchy Natural Products' position

A lower blossoming has had an impact of expected volumes for next year, which could be as much as 30% lower. Combined with low prices, it is clear today that businesses have been taking long positions to cover their needs. Local stakeholders are scrambling to export volumes before the closing of the market in anticipation of higher prices for the coming season. In the first purchases of green vanilla in Ambanja, we saw prices at 15,000-20,000 Ariary per kg and 30,000 – 35,000 Ariary in the Sava region, nearly double the prices of last year’s green campaign. Although limited in volume, prices in Ambanja are often an indicator of expected prices in the main green vanilla markets of the Sava region.

However, when we take an objective look at the expected production combined with last year’s carry-over, the supply could still be significant in 2024-2025. Furthermore, with end business buyers taking long positions, it is not certain yet whether the current buying pressure will be sustained at the re-opening of exports. Well stocked buyers could be patient in their next season purchase, which could slow down the current price trend.

As a certified business operation with a local presence in multiple vanilla producing regions, De Monchy Natural Products works to implement and improve sustainability projects in the countries of origin. We work closely with both our customers and our partners at the source to promote sustainable development through Organic, Rainforest Alliance™ and Fair Trade certification of our farmers. This helps us to guarantee minimum purchase volumes through our farmer associations.

The demand for certified, sustainable and traceable vanilla is growing, which is in line with our strategy and helps to increase revenue to farmers. However, today only 15 to 20% of volumes exported are certified, which means the industry still has a long way to go in achieving significant sustainability goals.

There is still uncertainty regarding government policies. Many questions remain surrounding re-opening of export dates, possible price interventions and official list of authorized exporters, making it extremely challenging for preparators and exporters to plan their purchases on the green and vrac markets once again. Naturally, this situation has a direct impact on farmers and their livelihoods who are facing uncertain buyers.

Furthermore, this continuing challenge is testing the loyalty of end buyers to the Madagascar origin, which could prompt end users to favor other, more stable origins.

Indonesia & Papua New Guinea

Indonesia has seen a rather lagging response from the market price developments in Madagascar. Prices have remained high for the better part of last year, while export volumes have been limited to only +/- 150MT in 2023.

This can be explained by some local actors taking long speculative positions, hoping to bank on profits in the upcoming months or next year.

For 2024, we expect the production at around 300MT based on communication with farmers and observation of blossoming. However, due to unusually hot weather, beans are ready for harvest earlier, which brings uncertainty on maturity. As such, these beans will contribute to higher volumes of EP Cut grades compared to other grades.

For Black and Extraction grades, the positive trend started last year is expected to continue with expectations of Vanillin Content of 1.5% and up for industrial volumes. On the specialty product market, where we see small volumes and shipment sizes, even higher vanillin content is achieved.

Analysis reports from local laboratories continue to be questionable, with Vanillin Content often measured significantly higher than the more conventional numbers from European facilities. Such discrepancy can be explained by different calibration and testing methods.

Indonesia is still behind in terms of food safety quality parameters, most notably pesticides (including Nicotine), heavy metals, microbiology and MOSH/MOAH. This is why it is important to have an integrated food safety management system throughout the supply chain.

And lastly, sustainable and traceable bean production remains low in the archipelago. 2023 exports of Organic and Rainforest Alliance™ certified beans were only at around 9MT.

This is why De Monchy Natural Products is currently working on a major certified and traceable Indonesian vanilla project in 2024, in line with our commitments to a sustainable vanilla supply chain and an improvement of the livelihood of farmers at all origins.

In Papua New Guinea, the situation remains uncertain due to the political situation as well as opaque price and volume data. Speculating action from major local actors contributes to an unclear picture of exactly how much is exported versus actual production.

In addition, farmers and exporters are turning their attention to cocoa, a commodity which has seen a huge price increase this year.

In the past, a lot of cross-border transactions were made between Papua New Guinea and Indonesia. However, currently we see a lot less activity at the border, but the reason is still unclear behind this observation: it could be from lower demand, direct exports, or from local actors building stock for speculation.

Uganda

Major efforts have been made in the past few years by industry actors to promote Uganda as a credible alternative origin. And with good reasons: the country enjoys two crop seasons per year for a more stable supply of vanilla; the government actively promotes the vanilla industry with various subsidies and support programs for producers as well as exporters; and the quality of Uganda vanilla is outstanding, achieving vanillin content above 2% on average.

Despite these efforts, the Uganda vanilla industry has suffered greatly from downturn originating in Madagascar. Large crop outputs amid an oversupplied market and an origin still fighting for market shares led to Ugandan vanilla prices suffering the largest industry drop for the 2023-2024 season.

Frustration within the farming community is palpable and the temptation to destroy vines and switch crops is strong. Veteran farmers have witnessed large price fluctuations in the past, so they are more patient than newer generations in waiting out the downtrend. However, it is not certain that they could wait out another low sale season. With coffee and cocoa prices increasing, they offer an attractive alternative to newer farmers tempted to abandon vanilla.

In Q1, exports from Uganda were limited, but started picking up in Q2 2024, mostly from traders taking long positions amid hopes of a bullish market. A global price increase would benefit Ugandan vanilla, enabling it to position itself as a cheaper alternative to Bourbon vanilla.

Production is expected to stand at 250 to 300MT for the 2024-2025 season, with some significant carry-over from last year.

Interested in buying vanilla?

We can share with you our product catalog and our sales will be happy to assist you further.

Please fill in the form to receive our product list.

- Certified

- Sustainable & Ethical

Conclusion

Overall, we can say with confidence that the price fall experienced in 2023 has stabilized due to lower future volume expectations. That said, it does not mean that we are now entering a fully bullish vanilla market yet. Oversupply and large carry-over stocks at all origins is still a reality, even if the situation has slightly improved compared to last season.

On the demand side, we are not convinced that it can sustain the strong export volumes we’ve seen in this first half of 2024. Relatively low prices are prompting long positions from end buyers, meaning that stocks could remain high in Europe and North America until at least the end of the year, which could have an impact on exports and prices entering Q1 2025.

From a regulatory perspective, especially in Europe, the uncertainty surrounding Nicotine has subsided. While MRLs for conventional beans have come back down to previous levels before the discussions at the European Commission, it has brought Nicotine to the spotlight. As a compound that was not often tested, it is now systematically a part of specification requirements from end buyers and must be monitored throughout the supply chain.

Nicotine is only one of more upcoming regulatory scrutiny in the European Union. In the coming years, more hazards such as MOSH/MOAH, microplastics and PFAs will need to be part of monitoring and prevention steps for suppliers who are serious about food safety.

One of the ways to alleviate these risks is to start through education on best practices at the farmer level. This is why now, more than ever, sustainable development programs are critical. These programs are built to benefit the whole supply chain, starting with providing a fair income to farmers while improving the quality and safety of cultivated products for the consumer.